While the Bank prioritises prudence in its fundamentals, it pursues a complete innovative approach in enhancing its Social and Network Capital (relationships with customers, suppliers, business partners and the community) and Intellectual Capital (internal knowledge, systems, and processes). Our efforts here encompass both digital transformations as well as sustainability initiatives that align with the United Nations Sustainable Development Goals (SDGs). We make a deliberate attempt to consider these two spheres of innovation as interlinked; after all, the implicit promise of technological innovation is to improve the lives and livelihoods of all our stakeholders. This is especially relevant in a banking environment that is more interconnected and interdependent to the wider world than ever.

Fortifying Digital Leadership

Digital penetration and engagement

It is clear that we are living through a digital revolution, a period of rapid change to the country’s economy and financial ecosystem. Technological developments are upending conventional business models and competition in the financial sector is intense and unforgiving. The operating environment is beset with new risks, including threats to data protection and cyber security, compliance breaches, and damage to institutional reputations. The potential impact of failing to manage these risks may be devastating.

This period of transition requires us to be mindful of the different sensibilities and demands across all our stakeholders, as various segments adjust to change at different rates. We continued to view digital innovation as a Transformation Change Agent or, in other words, as a catalyst for transforming our relationships with our customers as well as our internal processes. We employed a staggered approach throughout the year that aimed at increasing the rates of adoption and usage of digital platforms by our customers. This approach also allowed us to engage in a process of co-creation in our products and services by responding to customer feedback and expectations.

| 2019 | 2018 | |

| Digital Penetration (%) | 23 | 18 |

| Electronic FD vs Total FD (%) | 23 | 16 |

Despite these challenges, our progress reflects that we are well positioned to cross 30% digital penetration on online and mobile platforms in terms of transaction volumes by mid 2020. Multiple studies have shown that once this threshold of digital penetration has been passed, adoption escalates exponentially thereafter. More than two thirds of transaction volumes are currently taking place on electronic channels. Moreover, crossing this threshold will provide us with a comprehensive pool of data from which we can build on our digital analytic initiatives.

Innovating and strengthening our platforms

Currently, our online banking is the most subscribed platform in the country. Our online platform already enables customer services such as fund transfers across all banks instantly, real-time cross-currency transactions, and a wide array of bill payments. Throughout the year under review, we progressively enhanced the available features of this platform, aiming at providing the customer all the features of a bank branch on their laptop or mobile phone, from applying for facilities online, setting up fixed deposits and investing in treasury bills, to effecting share trading payments 24/7, 365 days of the year. We also added new features enabling both personal and corporate customers to make payments of charges to the Sri Lanka Ports Authority and Electronic Tolls via our platform. To encourage our customers to make the move to digital banking, our entire ATM network has been upgraded this year to allow registration for online and mobile Banking accounts.

In addition, we launched two new apps this year as part of our digital strategy. ‘ComBank RemitPlus’ is an App for our migrant customers to familiarise on remittance-related information, services and products on offer for the segment and helps us further consolidate our position as one of the market leaders in this field. ComBank e-Slips, a QR-based trilingual App available to Bank customers as well the wider public, allows cash to be deposited to savings or current accounts without the use of deposit slips. We also plan to launch a mobile App aggregator to house the full suite of mobile Apps on our customers’ phones.

The tumultuous economic challenges of the year, however, derailed our efforts at implementing our new customised banking platform, Combank Digital, before the end of the year, however we hope to launch it by April 2020. This platform will amalgamate our various portals, providing customers with a seamless ‘omni-channel’ experience across all devices (and will be available in all three local languages, as well as in Bengali and Dhivehi to serve our Bangladesh and Maldivian markets, respectively). Combank Digital represents an upgrade to industry-leading security standards, something of vital concern for both current and prospective customers. Encompassing such features as integration with voice interactive virtual assistants like Amazon Alexa and host-to-host connectivity for Corporate online banking, Combank Digital provides us with the infrastructure and functionality for our future growth in the expanded digital banking ecosystem.

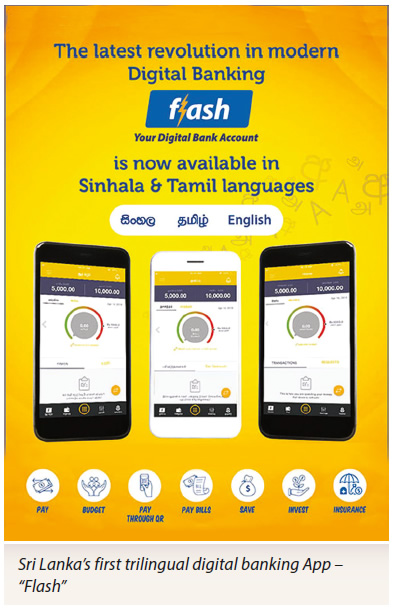

Targeting generation Y and Z

Our Flash Digital Banking App, launched in middle of 2018, showed encouraging growth during 2019 with over 20,000 customer registrations. The Flash App is positioned as a ‘digital only bank’, i.e. complete digital functionality that obviates the need for the customer to visit the Bank for transactions. This functionality, together with its unique personal financial management tools, addresses the demands of Generation Y and Z customers. This year, we launched Sinhala and Tamil versions of Flash, making it Sri Lanka’s first trilingual digital banking App, which will allow us to appeal and cater to other under-banked and unbanked segments of the market. We envision Flash as a tool of financial inclusion and democratisation, accelerating the pace of digital adoption throughout Sri Lanka. Flash currently offers 100% digital, customer on-boarding, with the exception of a single visit to a branch of the Bank to comply with Sri Lanka’s current KYC requirements. As the country’s regulatory environment changes in line with the increased digital penetration, Flash has positioned the Bank as a market leader in digital banking. We also launched a unique insurance scheme via Flash.

With the launch of Blockchain technology for remittances in April 2019 by partnering with RippleNet, both inward and regulator-enabled outward blockchain technology-powered remittances became reality.

Joining RippleNet ensures that remittances are received instantly with an end-to-end tracing and tracking solution, ensuring that the process is transparent and tamper-proof, and that remittances of lower denominations are viable due to the application of lower rates.

RippleNet’s technology facilitates a simplified experience for customers by offering a simple remittance process with the removal of multiple steps. Blockchain also provides the ability to move money on real time basis, leading to improved productivity.

Creating a Sustainability Strategy

Given the magnitude of certain emerging trends such as technological advancements, demographic changes, regulatory developments, changing customer and stakeholder expectations, the Bank takes a holistic and innovative view of sustainability that foregrounds creating value for all our stakeholders across the short, medium and long term. A pre-condition for the Bank’s ability to sustain its performance as a going concern is, of course, its profitability. Currently there is widespread acknowledgement throughout the corporate world for the traditional mantra of maximising immediate shareholder returns to be weighed against wider responsibilities to the society and environment. This, in turn, requires us to balance trade-offs and tensions in the investment and expenditures of our various capitals. The emphasis on various time frames reflects an understanding that these relationships are symbiotic; when viewed from the perspective of sustainability, ensuring productive outcomes for the society and environment is completely consistent with the interests of the shareholder in the long term. Therefore, our sustainability strategy is thoroughly integrated into our core business activities and inculcated to the ethos of our Bank staff.

During the year under review, the centerpiece of the Bank’s sustainability efforts was a formal exercise to identify and prioritise our key strategic sustainability themes. The outcome of this exercise was a mandate to focus on five key areas:

- Advancing Financial Inclusion and Literacy

- Social and Environmental

Risk Assessment - Promoting Green Finance

- Environmental Conservation

- Supporting Education

We then correlated these five areas of focus with the 7 SDGs most relevant to the Bank’s activities:

|

|

|

| Quality Education | Gender Equality | Affordable and Clean Energy |

|

|

|

| Decent work and Economic Growth | Industry, Innovation and Infrastructure | Responsible Consumption and Production |

|

||

| Partnerships for the Goals |

While all 17 UN SDGs potentially bear on the Bank’s activities, we believe that prioritising these 7 SDGs allows us to build a clear, coherent, and targeted strategy to concentrate our efforts in key areas.

To drive this strategy, we also established a Cross-Functional Steering Committee to coordinate the Bank’s array of sustainability initiatives. This committee represents our understanding that sustainability considerations cannot simply be regarded as the domain of a dedicated unit or department, but must be deeply integrated within our core decision-making processes and business activities.

This exercise paved way for us to map the areas through which the Bank can drive its sustainability strategy. Given the multifaceted nature of our sustainability initiatives, this section of the Management Discussion and Analysis will discuss our efforts during the year in collaboration with other partners for sustainability goals, green financing, and special social and environmental projects. The reader of this report will find the discussion of various other aspects of our 2019 sustainability strategy and performance in the following sections:

|

|

accelerating financial inclusion and literacy, particularly of underserved communities and youth segments |

|

|

actively supporting the development of SMEs and Micros (see pages 49 to 51); |

|

|

empowering women in the broader economy through targeted products and services (see page 50), as well as ensuring that the working environment is free of any forms of discrimination |

|

|

establishing industry leading data security and customer information protection standards mechanisms |

|

|

managing the direct environmental risks and impacts resulting from the Bank’s operations |

|

|

ensuring safe and fair working conditions by adhering to recognised standards and principles for labour practices (see page 57) |

Partnerships for the Goals

Banking, as an industry in itself, has a comparatively small environmental footprint; it consumes a minimal amount of natural resources and creates small quantities of waste and emissions. Due to the nature of banks’ relationships and networks, they are in a position to be a crucial influencer and driver of sustainability on a wider societal scale. As one of the country’s premier banking institutions, we recognise and assume this responsibility, both within our own operations as well as in the financial sector as a whole. Establishing partnerships with private, public, non-governmental, governmental and international organisations is a key element of the Bank’s sustainability strategy. This holistic and synergistic view of sustainability itself is enshrined in SDG 17 (Partnerships for the Goals).

In the year under review, the Bank continued to productively collaborate on a leadership level as a Core Group Member of the Sustainable Banking Initiative of the Sri Lanka Bankers’ Association (SLBA-SBI), a signatory of the United Nations Global Compact (as well as a Steering Committee member of the UNGC Sri Lanka Network), and a Founder Member of the Business and Biodiversity Platform Sri Lanka. Our efforts with the SLBA-SBI, in 2019 in particular, were directed towards aligning the sector with the CBSL’s Roadmap for Sustainable Finance in Sri Lanka, a national initiative to provide guidance to the financial sector on effectively managing environmental, social and governance (ESG) risks in their business activities and increase support for greener, climate-friendly and socially inclusive businesses towards building a green and inclusive economy. We were a pioneer amongst Sri Lankan banks, to implement a SEMS in 2010, a robust due diligence and implementation process and a monitoring mechanism which ensures all our lending activities are environmentally and socially sustainable. This process has been inculcated at all levels of the Bank’s operations, including our new processes within our SME loan approval centralisation, along with our directives to both credit officers and sales staff. As part of our periodic review of the system towards continuous development, we engage IFC and other key stakeholders for feedback on improvements and take onboard their recommendations. Furthermore, our partnership this year with IFC to develop our capacities in Green Finance (see below) and Women Entrepreneurs was very sustainable.

At an operational level, the Bank continued to evaluate the sustainability practices of its business partners to ensure conformity to the Bank’s specified standards of conduct. Where concerns were identified, we worked to open productive lines of dialogue and encourage and instill sustainability values and best practices.

The Bank engages with estimated 1,200 number of business partners and has created a value of Rs. 10,426 Mn. during the year. Over 90% of value so created has been for the suppliers of local origin in both Sri Lanka and Bangladesh.

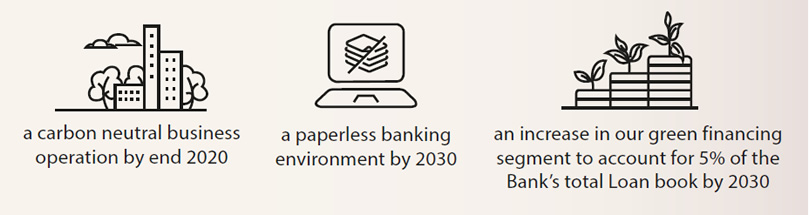

Driving green financing

Green goals

As part of our goal to increase our green loan portfolio to 5% of the Bank’s total loan book by the end of the decade, we continued our progress in green banking, even during a difficult year. Particular strides have been made in terms of the composition of our Green Loans, reflecting our initiatives to broaden our scope from focusing solely on facilities for renewable energy to now including energy and resource efficiency, smart agriculture, co-processing and other environmentally friendly projects.

A key objective of promoting green financing is to contribute towards the fight against climate change thereby supporting Sustainable Development Goals 7 and 12, Affordable and Clean Energy and Responsible Consumption and Production respectively.

Reflecting the difficult macro-economic conditions that prevailed during the year, the Green Loan portfolio declined from Rs. 15.97 Bn. in 2018 to Rs. 14.70 Bn. as at December 31, 2019.

Steps were taken to diversify the Bank’s Green Loan portfolio composition, to reflect our broader scope of Green Financing activities. The composition as of December 31, 2019 is given as follows.

|

|

Renewable Energy 33% |

|

|

Resource efficiency and recycling projects – Energy, Water and Material 32% |

|

|

Environmentally friendly transportation and related services 14% |

|

|

Water saving – consultancy and related service providers13% |

|

|

Other Green Financing advances 8% |

The Bank’s robust SEMS, which was upgraded in 2018 with the assistance of the IFC, continued to guide our assessment and management of social and environmental risks and ensures that the Bank follows responsible and sustainable lending and investment activities. All facilities above Rs. 100 million in value are evaluated by the SEMS Manager; but additionally, during the year under review, we broadened our approach to implementing a SEMS perspective in all our lending activities. This approach was inculcated to all levels of our operations, including the new processes within our SME loan approval centralisation, along with directives to both loan officers and sales staff. This represents a fundamental cultural change that will be crucial to our efforts at sustainable value creation.

These initiatives were supplemented by our adoption of an IFC developed tool, the Climate Assessment for Financial Institutions (CAFI) tool that assists in monitoring and reporting climate impact data. This tool provides an assessment of the environmental impact of proposed and ongoing projects. This tool allows us to invite our customers to participate in this process of climate impact assessment, creating a sense of transparency in our sustainability measures.

CAFI was implemented in 2019. The Bank has established a reporting mechanism whereby the climate impact data of the Green Financing portfolio is reported and logged via the CAFI tool.

As part of continuous improvements to the process, the Bank continued to develop capacity and strengthen internal knowledge and skills by conducting four training programmes for credit and lending officers and relationship managers on both Green Finance and SEMS, this year.

Special projects

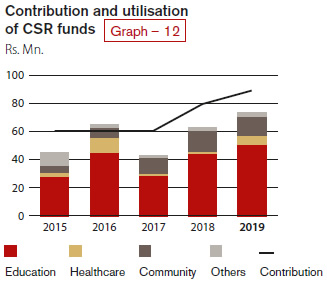

Taking our innovative approach beyond banking, the Bank carried out a series of special projects that broadly focused on education, healthcare and environment conservation throughout the year. These initiatives are expected to make an impact on a range of stakeholders and equip them with the required skills, competencies and attitudes for the emerging future.

Some highlights include:

Supporting education and employability:

- An entrepreneurship development programme for Vocational Training students in Badulla; a donation of computers and furniture to a newly opened Vocational Training Centre in Waradala, Mellawagedara; an innovative computer coding promotion programme in Kotte; setting up of a Math Lab at the four-day Shilpa Sena Exhibition; providing financial assistance to the Sasnaka Sansada Foundation to conduct a ‘Training of Teachers’ (ToT) programme for Mathematics teachers; donating our 180th and 181st IT Lab to the School of Sri Lanka Corps of Military Police and the School of Artillery in Minneriya, respectively; providing financial support for the construction of Sri Lanka’s first model vocational training centre for children and youth with Autism.

Promoting environmental conservation

- A mangrove restoration in Koggala in collaboration with Wildlife and Ocean Resource Conservation (WORC) of Sri Lanka; A mangrove planting and beach clean-up in Mannar; a country-wide tree-planting campaign involving 40 schools; built a 15,000-litre water storage and supply project to address the water shortages affecting the forest monastery of Nimalawa Aranya.

Healthcare

- Donated and installed a complete water treatment plant at the Passara District Hospital; donated a Continuous Renal Replacement Therapies (CRRT) machine to the Nephrology Unit of the National Hospital of Sri Lanka (NHSL); provided aid to 2,000 families affected by floods in the Mullaitivu and Kilinochchi districts.